Elevating User Experience in HMRC’s Live Services

Client Background: As the Senior Interaction Designer working with Her Majesty’s Revenue and Customs (HMRC), the focus was on enhancing the user experience across various live services, with a specific emphasis on the online company tax service. The role involved collaborating closely with the development team, project manager, content designer, and researcher to maintain and improve these critical services.

Objective: The primary objective was to ensure a seamless and user-friendly experience for individuals and businesses using HMRC’s live services. The specific goal was to enhance the online company tax service, addressing user pain points and improving overall usability.

Design Process:

- Understanding User Needs:

- Conducted thorough user research to understand the needs, challenges, and expectations of users interacting with HMRC’s live services, with a focus on the online company tax service.

- Collaborated with the content designer and researcher to gather insights into user behaviors and preferences.

- Collaborative Squad Structure:

- Worked within a tight-knit squad structure, collaborating closely with the development team, project manager, content designer, and researcher.

- Established clear communication channels and workflows to ensure efficient collaboration and information exchange.

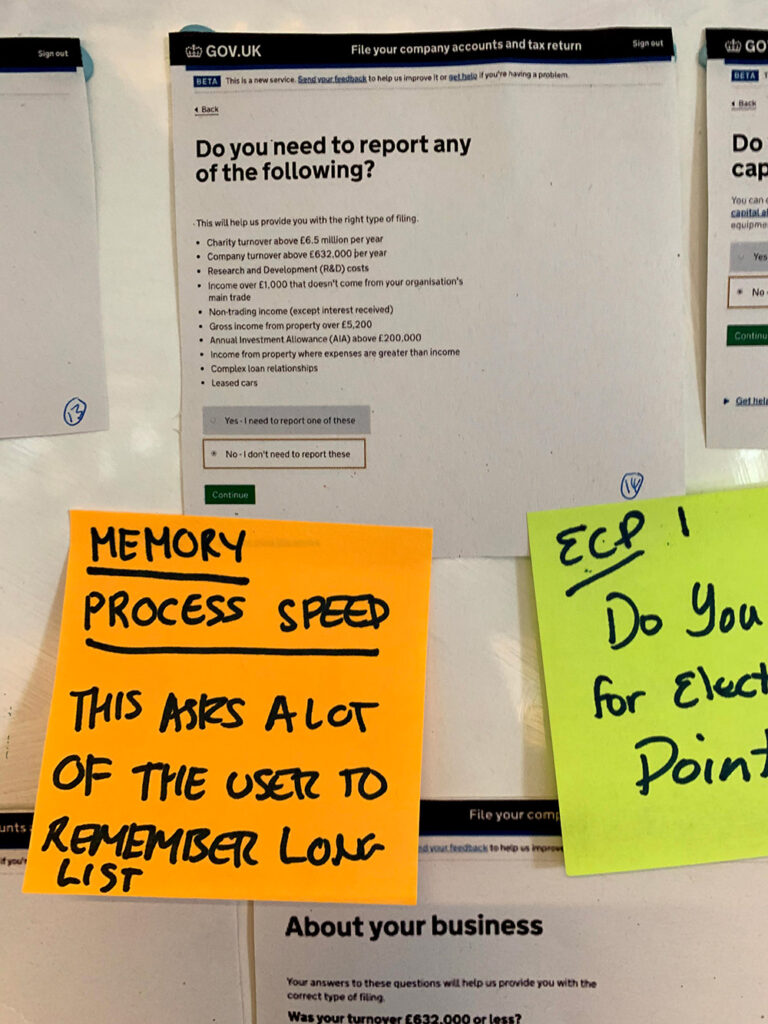

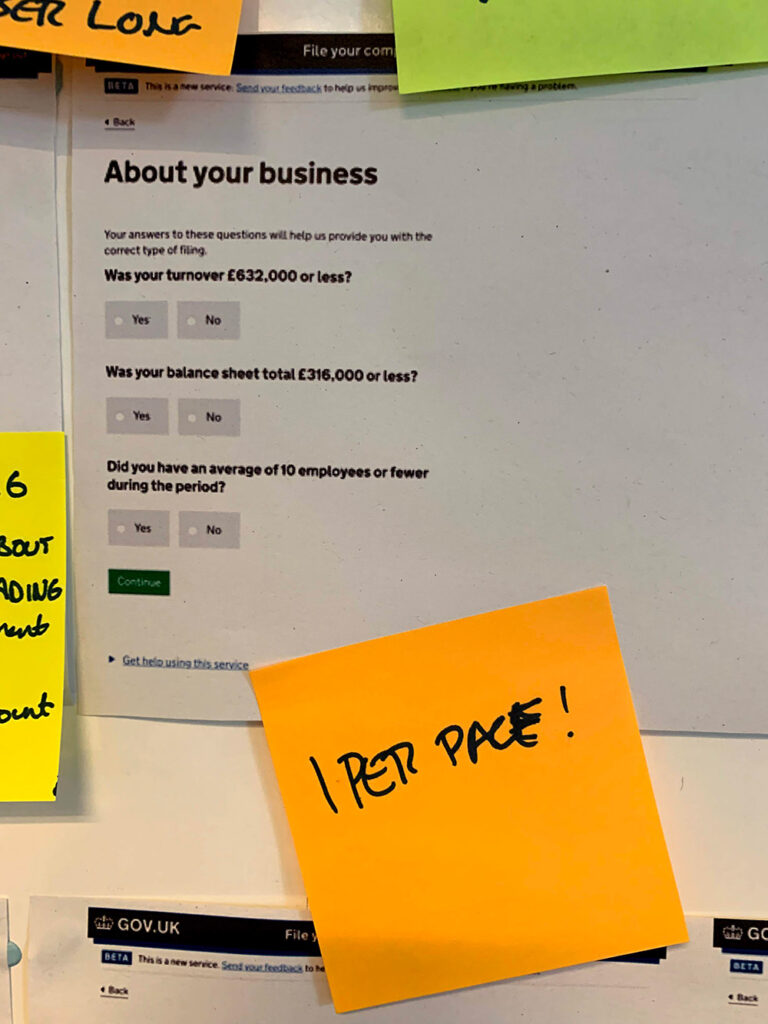

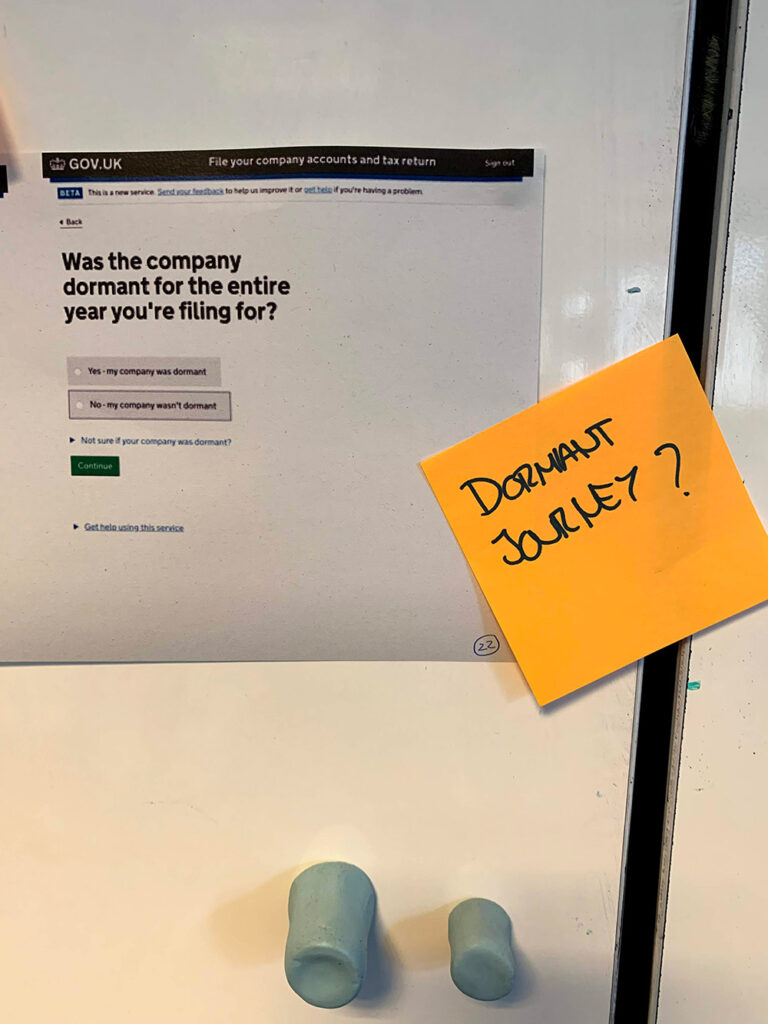

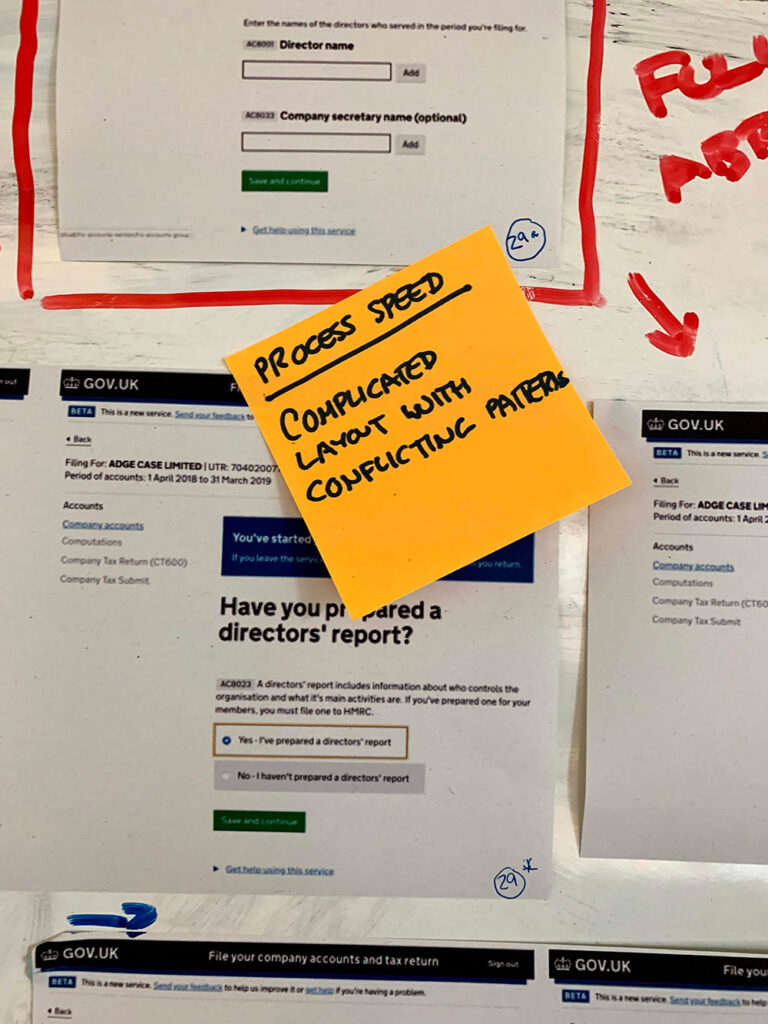

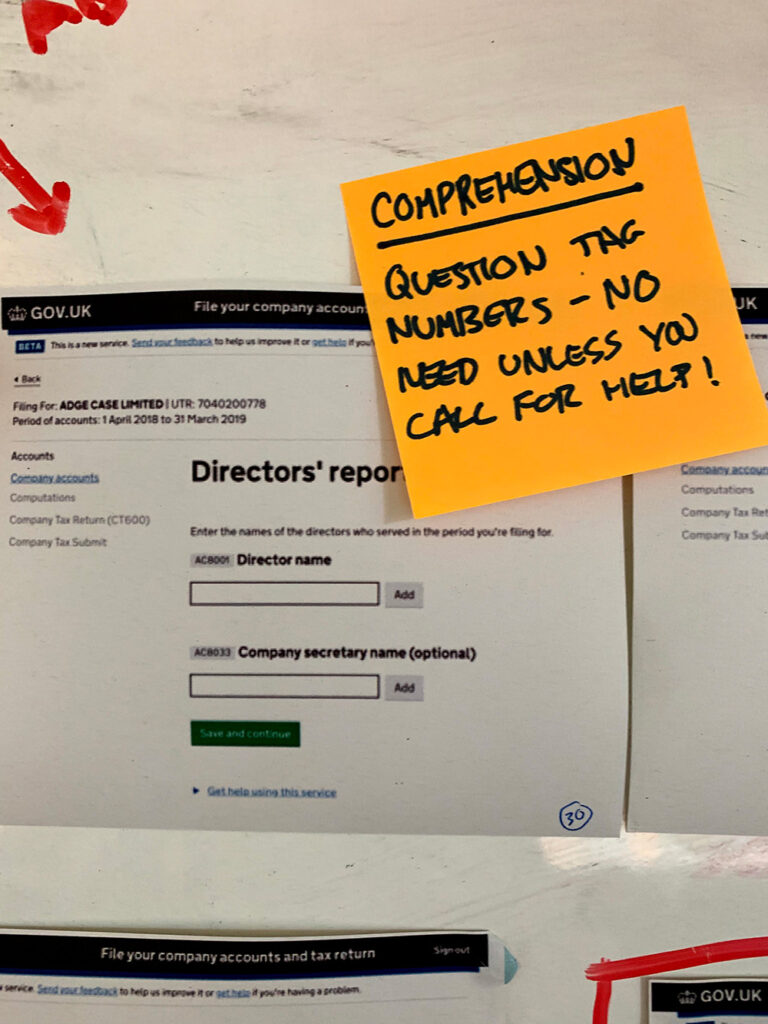

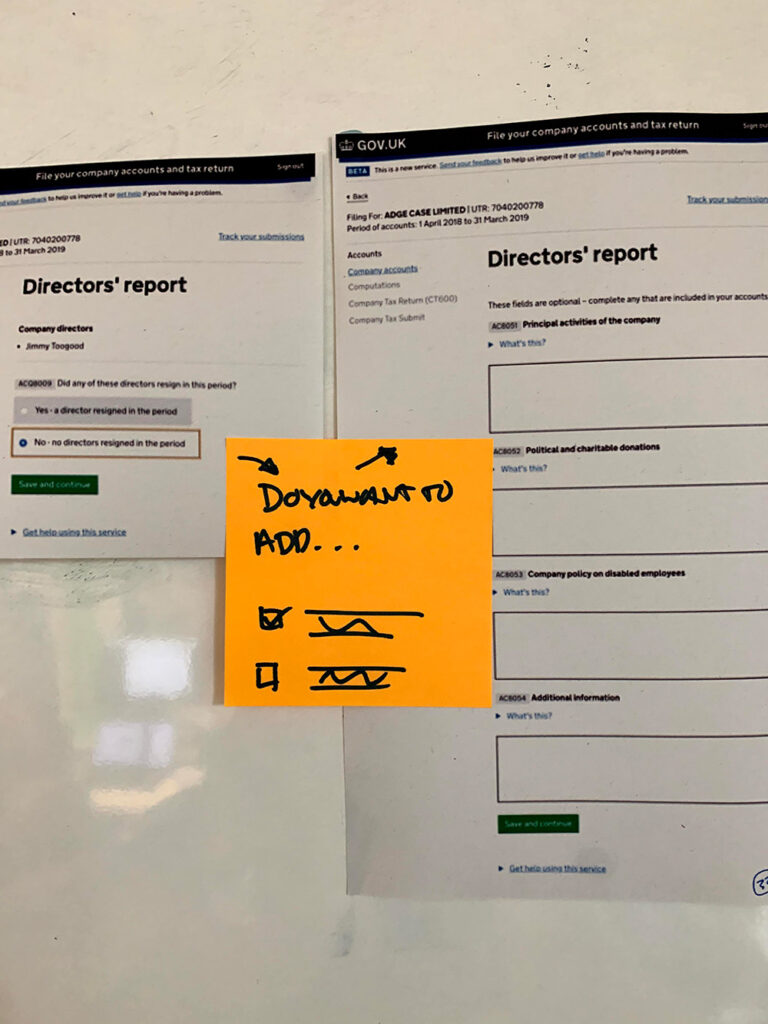

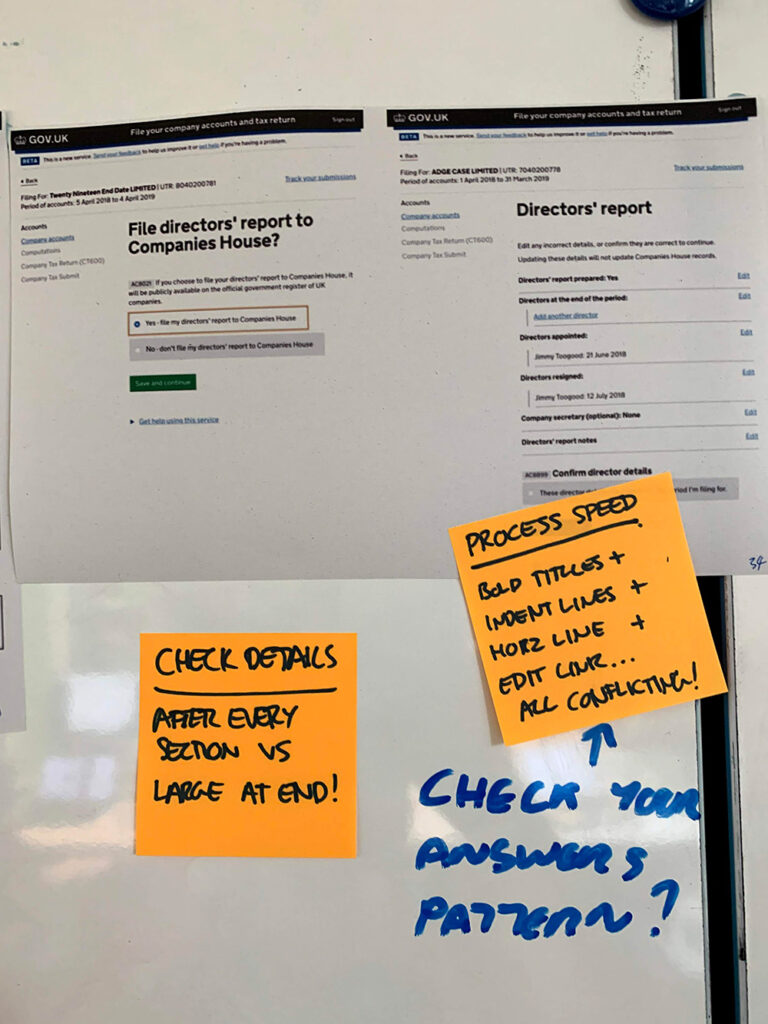

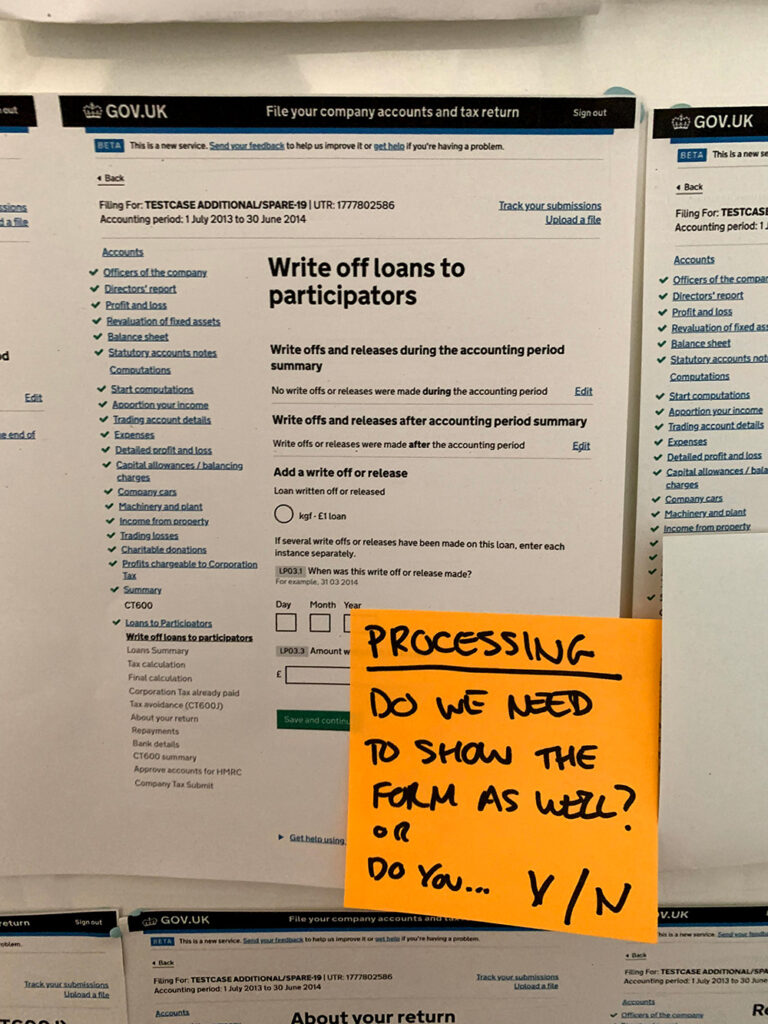

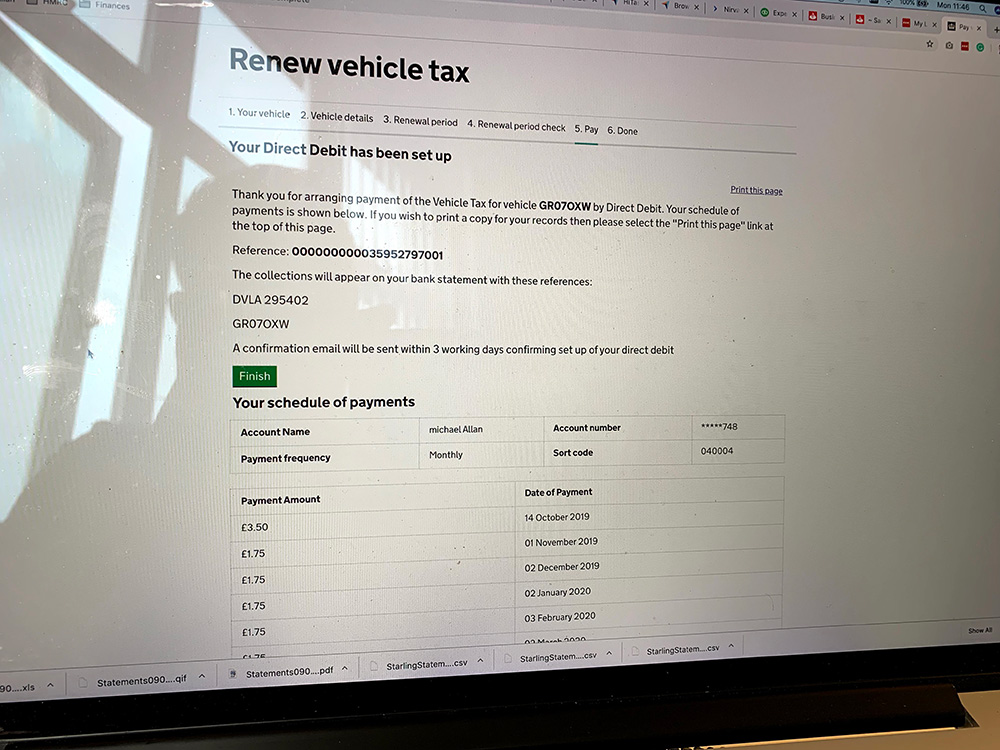

- Iterative Design and Prototyping:

- Engaged in an iterative design process, creating prototypes and mockups to visualize proposed improvements to the online company tax service.

- Conducted usability testing on prototypes to gather feedback and refine designs based on user insights.

- Responsive Design for Diverse Users:

- Ensured that the design accommodated a diverse user base, considering accessibility standards and responsive design principles.

- Collaborated with the content designer to create clear and concise messaging for a wide audience.

- Continuous Improvement:

- Implemented a continuous improvement mindset, regularly reviewing user feedback and analytics data to identify areas for enhancement.

- Collaborated with the development team to implement iterative updates and improvements to live services.

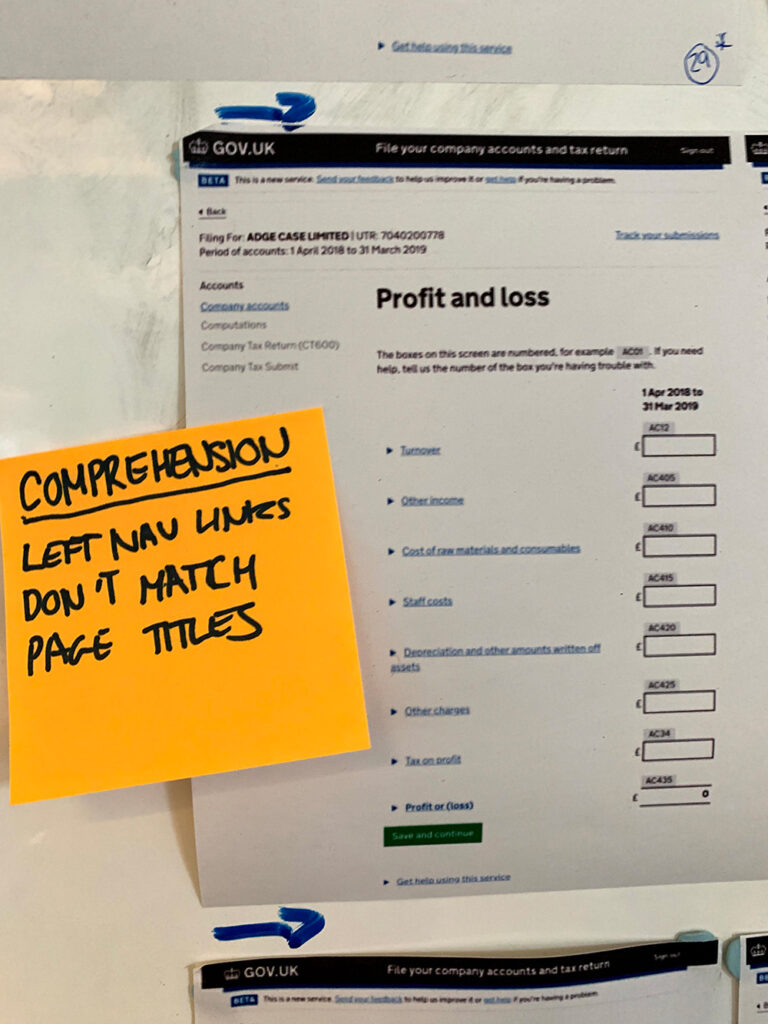

- User-Centric Content Strategy:

- Collaborated closely with the content designer to develop a user-centric content strategy, ensuring that information was presented in a clear and accessible manner.

- Conducted content audits to streamline and improve the clarity of information provided within the online company tax service.

Outcome: The collaborative efforts within the tight squad structure resulted in a significantly improved user experience for HMRC’s live services, particularly the online company tax service. The iterative design process, user-centric content strategy, and continuous improvement mindset contributed to higher user satisfaction and streamlined interactions with HMRC’s digital platforms.

Next Steps: Continued collaboration with HMRC to monitor user feedback, address emerging needs, and proactively enhance live services in response to evolving user expectations and technological advancements.

This case study demonstrates the positive impact of a well-structured and collaborative approach in improving and maintaining critical live services for a government agency, showcasing the role of a Senior Interaction Designer in creating user-centric solutions within a tight squad environment.